Managing Your Investments

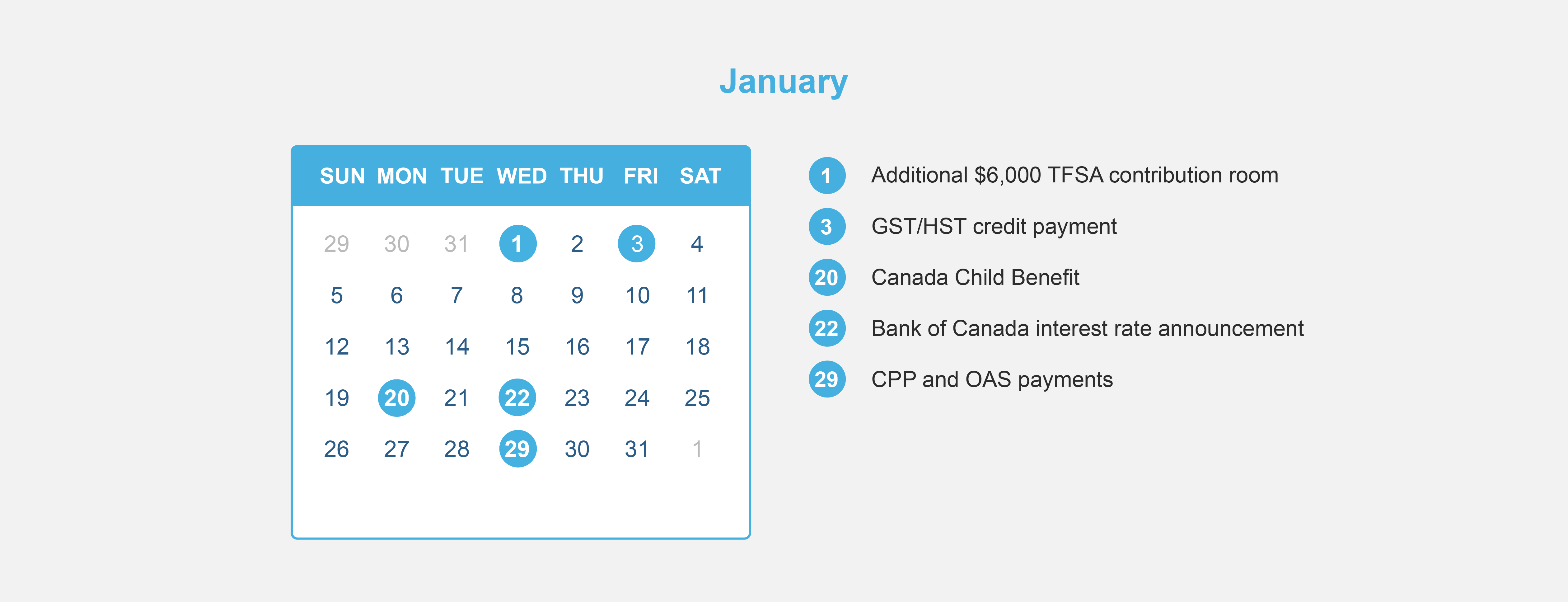

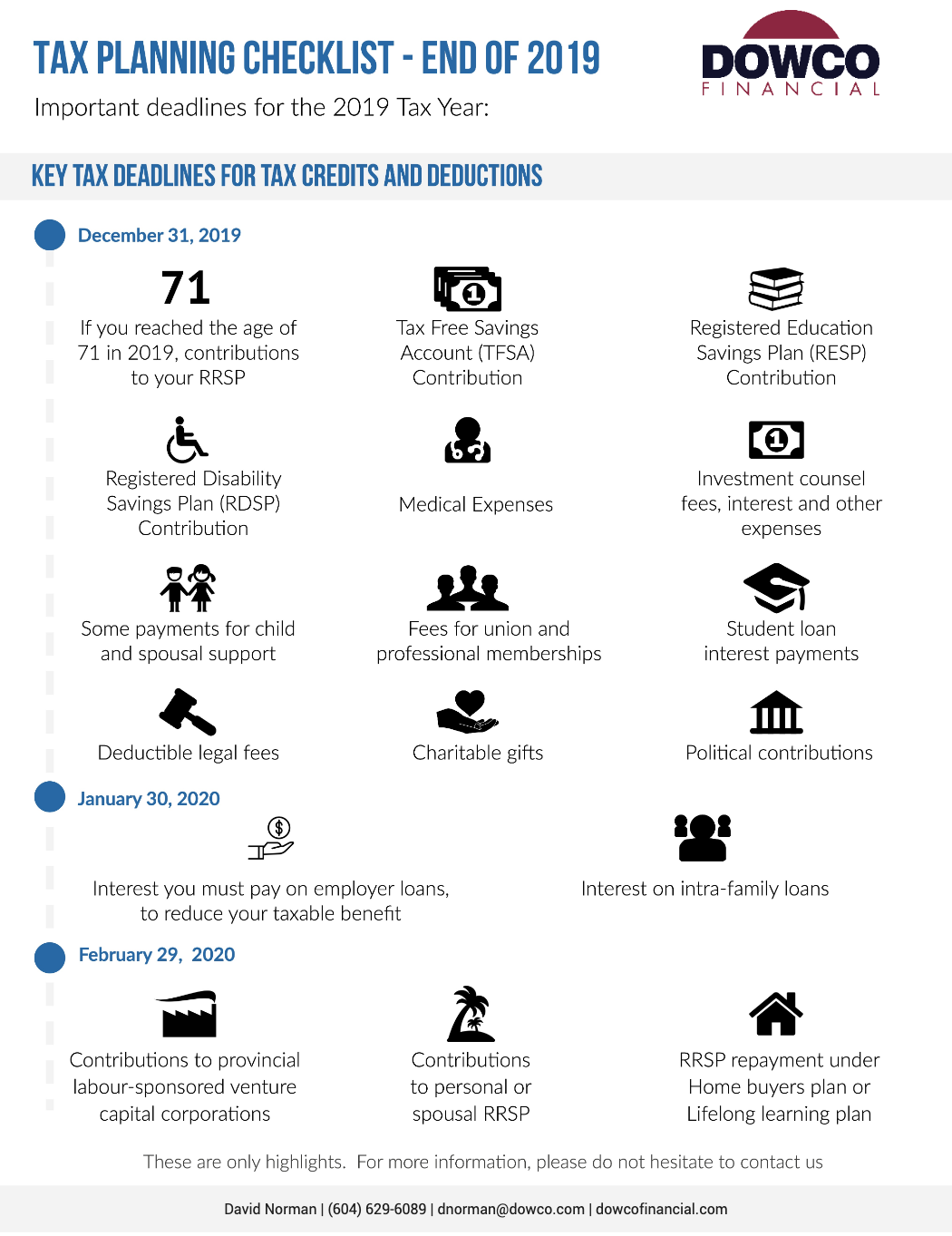

Use up your TFSA contribution room

If you are able, it’s worth contributing the full $6,000 to your TFSA for 2019. You can also contribute more (up to $63,500) if you are 28 or older and haven’t made any previous TFSA contributions.

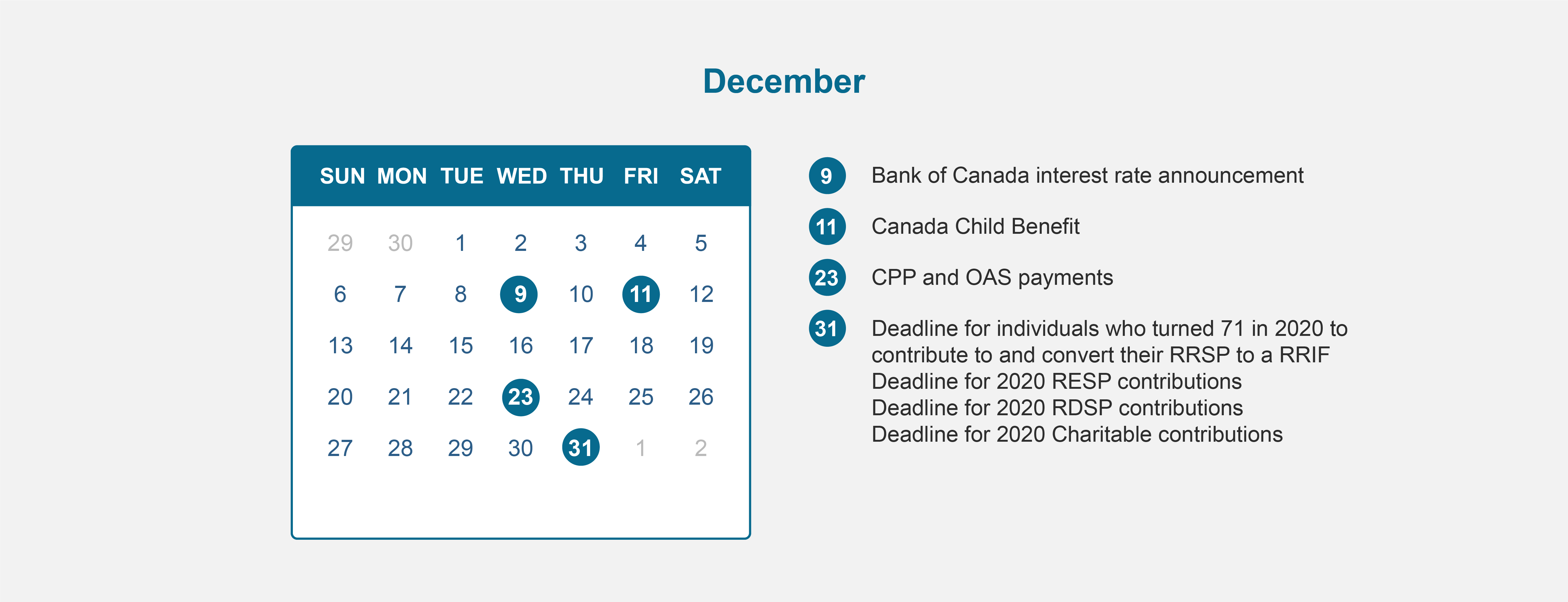

Contribute to Registered Education Savings Plan (RESP)

The Registered Education Savings Plan (RESP) is a savings plan for parents and others to save for a child’s education. The Canada education savings grant (CESG) will match up to 20% of contributions up to $2,500. That means the CESG can add a maximum of $500 to an RESP each year. Grant room accumulates until the child turns 17, therefore unused basic CESG amounts for the current year are carried forward for possible use in the future years. The income-tested Canada learning bond (CLB) is paid directly to the RESP by the Canadian government to low-income families. There are no personal contributions required to receive the CLB.

Contribute to Registered Disability Savings Plan (RDSP)

The Registered Disability Savings Plan (RDSP) is a savings plan for parents and others save for the financial security of a person who is eligible for the disability tax credit (DTC). The Canada disability savings grant will pay matching grants of 300%, 200% or 100% depending on the beneficiary’s adjusted family net income and amount contributed. The income-tested Canada disability savings bond is paid directly to the RDSP by the Canadian government to low- income Canadians with disabilities. Before December 31 of the year you turn 49 years old, you can carry forward up to 10 years of unused grant and bond entitlements to future years, as long as you met the eligibility requirements during the carry forward years.

Donate securities to charity

Make a donation by year end will provide you tax savings. If you donate eligible securities or mutual funds, capital gains tax does not apply, and you can receive a tax receipt for their full market value. Also, the charity gets the full value of the securities.

Think about selling any investments with unrealized capital losses

It might be worth doing this before year-end in order to apply the loss against any net capital gains achieved during the last three years. Any late trades should ideally be completed on or prior to December 24, 2019 and subsequently confirmed with your broker.

Conversely, if you have investments with unrealized capital gains which are not able to be offset with capital losses, it may be worth selling them after 2019 in order to be taxed on the income the following year.

Consider the timing of purchasing of certain non-registered investments

If you are considering purchasing an interest-bearing investment like a guaranteed investment certificate (GIC) with a maturity date of one year or more, you may consider delaying the purchase to the following year, so you don’t have to pay tax on accrued interest until 2021. You should also consider this with mutual funds that make taxable distributions before the end of 2019, consider delaying this until early 2020. Don’t pay taxes earlier than necessary.

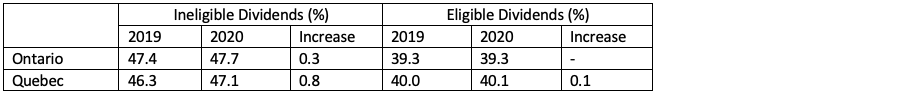

Check if you have investments in a corporation

The new passive investment income rules apply to tax years from 2018. They state that the small business deduction is reduced for companies which are affected with between $50,000 and $150,000 of investment income, therefore the small business deduction has been stopped completely for corporations which earn passive investment income of more than $150,000. At a provincial level, Ontario and New Brunswick have indicated that they are not following the federal rules to limit access to the small business deduction.