Exploring the Value of Group Benefit Plans for Your Employees

In today’s ever-evolving workplace landscape, employees place a premium on several key factors:

1. Alignment with employer values, especially sustainability.

2. Achieving a harmonious work-life balance.

3. Assistance in coping with the rising cost of living expenses.

4. Opportunities for delayed retirement.

5. Cultivating a sense of belonging within the workplace.

6. Flexibility in terms of work hours and location.

7. Ensuring job security.

If your business is experiencing growth and you’re considering adding group benefit plans to your employee offerings, you’re in the right place. We understand the importance of providing the right employee benefits solution for your business.

Understanding Group Benefit Plans and Their Value

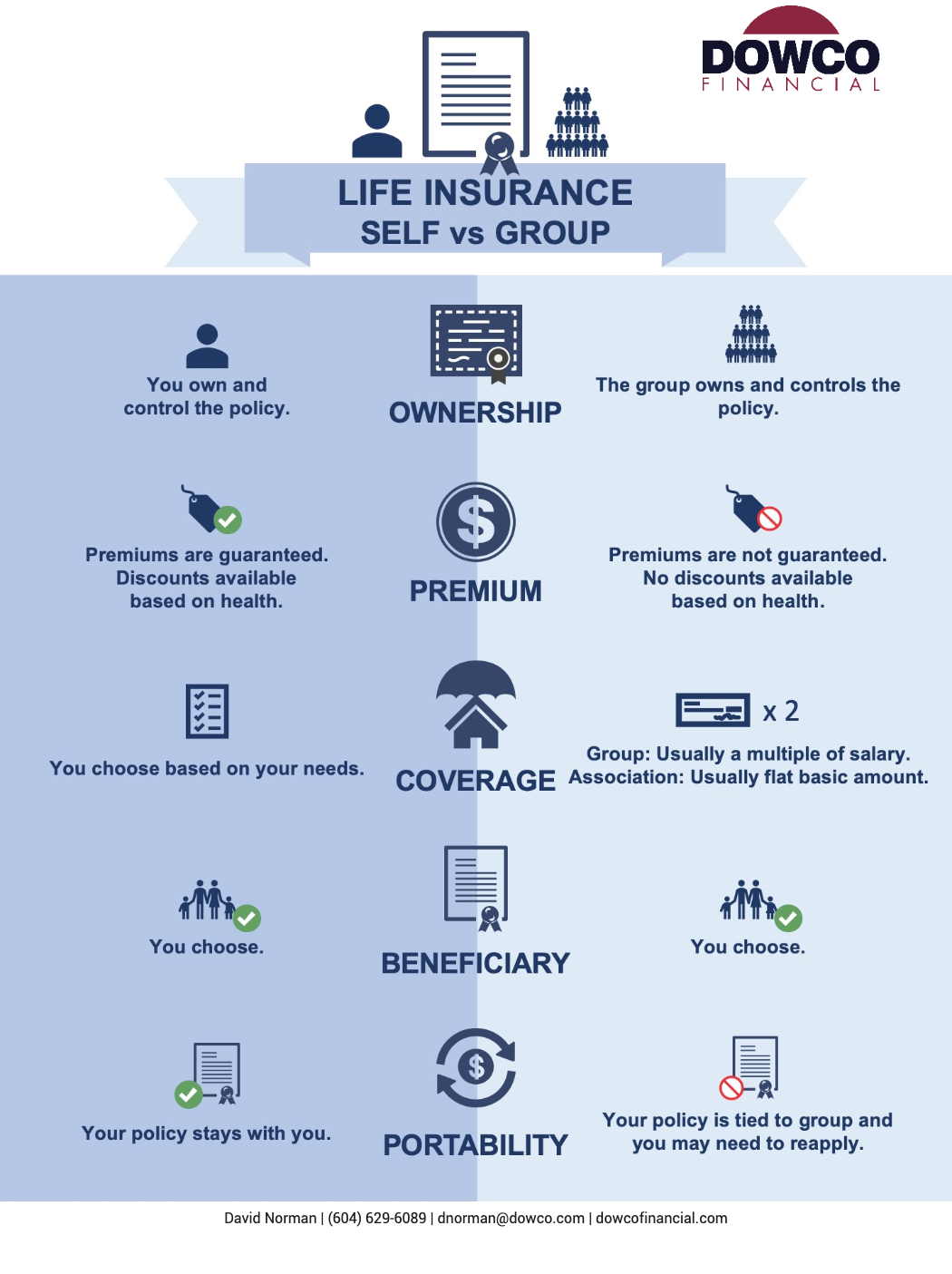

Group benefit plans form a crucial part of a company’s total compensation package, available to employees regardless of their seniority, position, or qualifications. These plans often encompass medical coverage for employees and their dependents. While it may seem like an additional expense during a period of growth, offering employee insurance benefits is essential for the long-term sustainability of your business.

So, why should your company consider offering group insurance benefits? Here are some compelling reasons:

1. Convenience: Group insurance benefits simplify healthcare coverage for your employees and their families.

2. Workforce Protection: These benefits provide a safety net for your staff, promoting their well-being.

3. Staff Retention: Offering benefits can help you retain valuable employees, reducing turnover.

4. Tax Benefits: Group insurance plans offer tax advantages for both employers and employees.

5. Customization: Plans can be tailored to meet your business’s unique needs.

6. Morale Boost: Providing benefits can boost productivity and morale among your workforce.

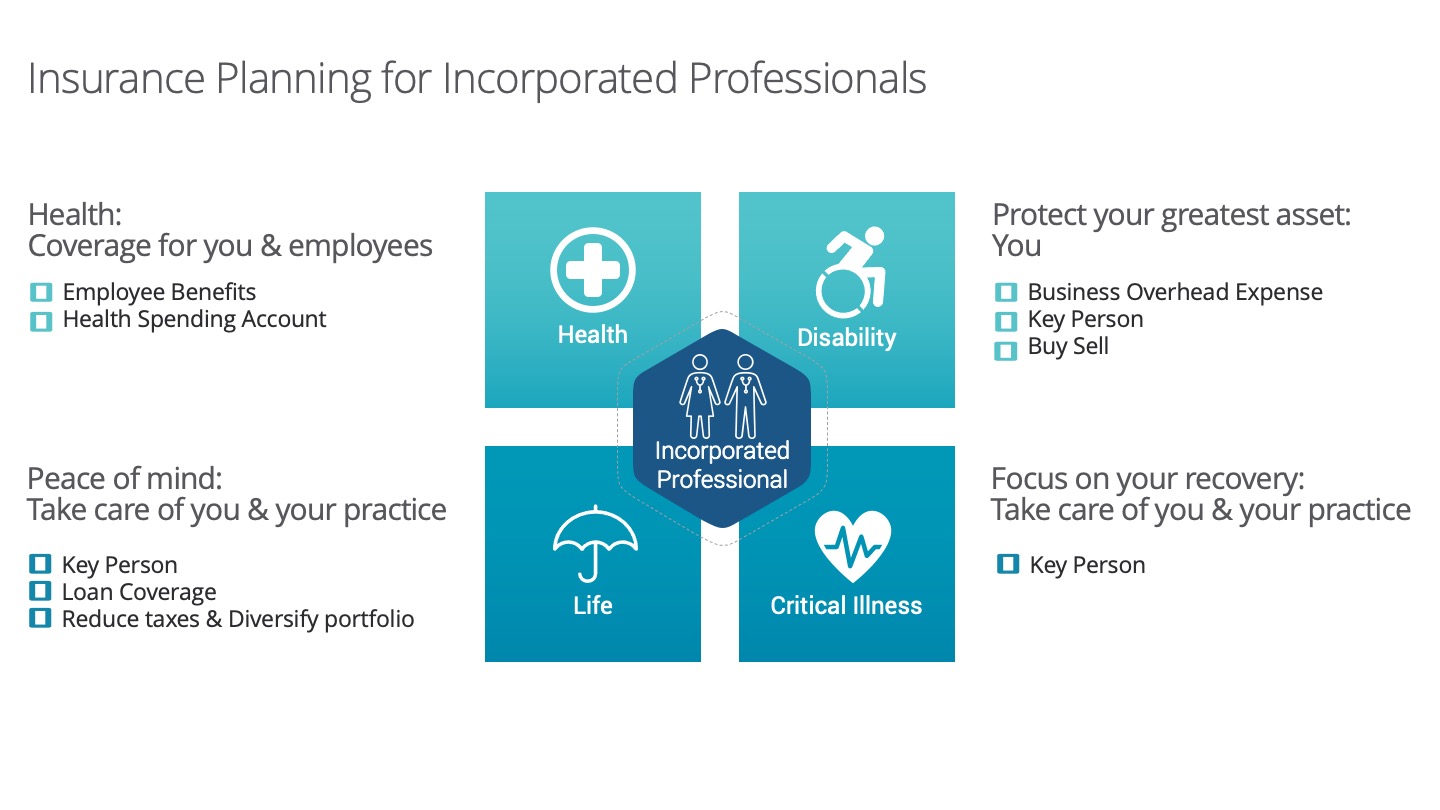

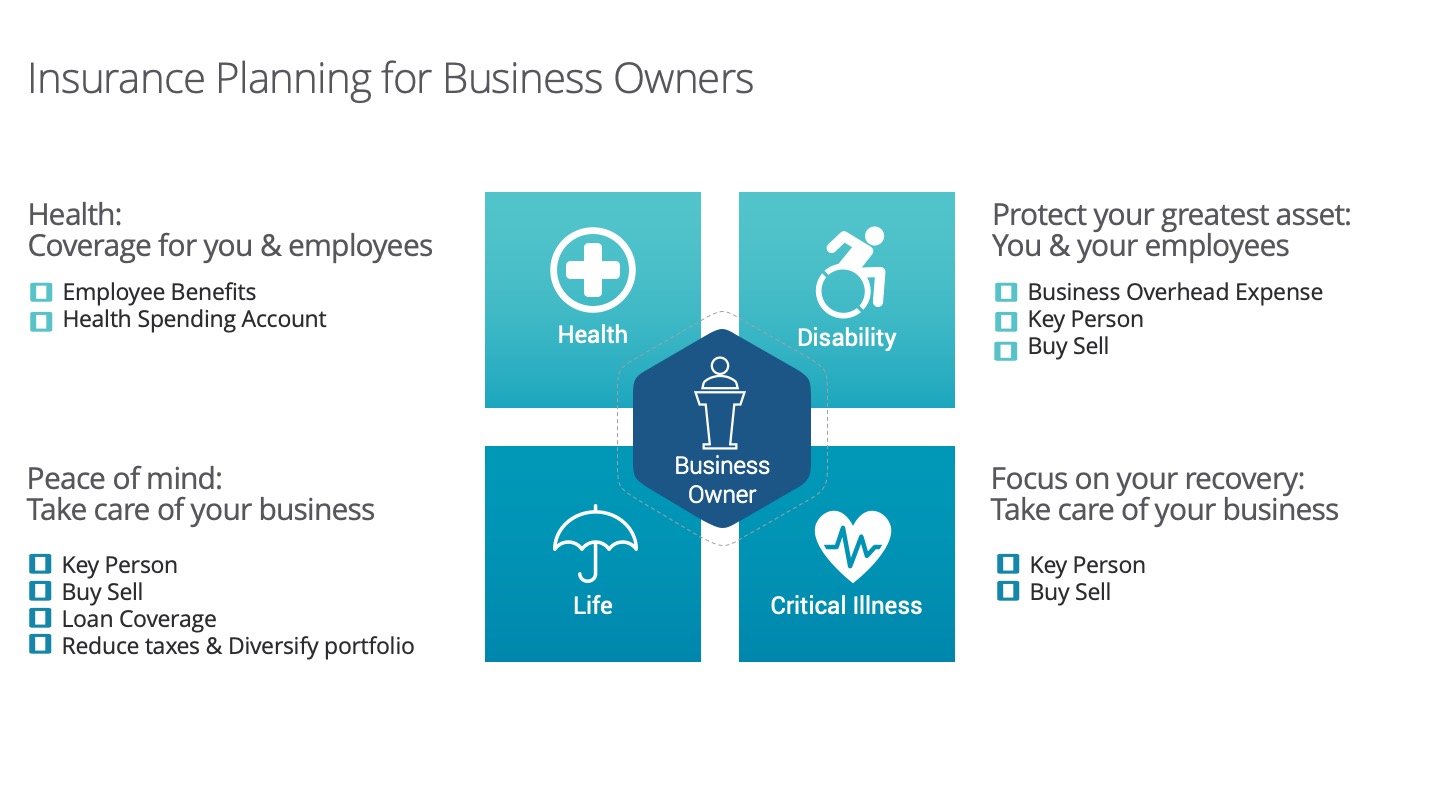

What’s Covered by Group Insurance Plans?

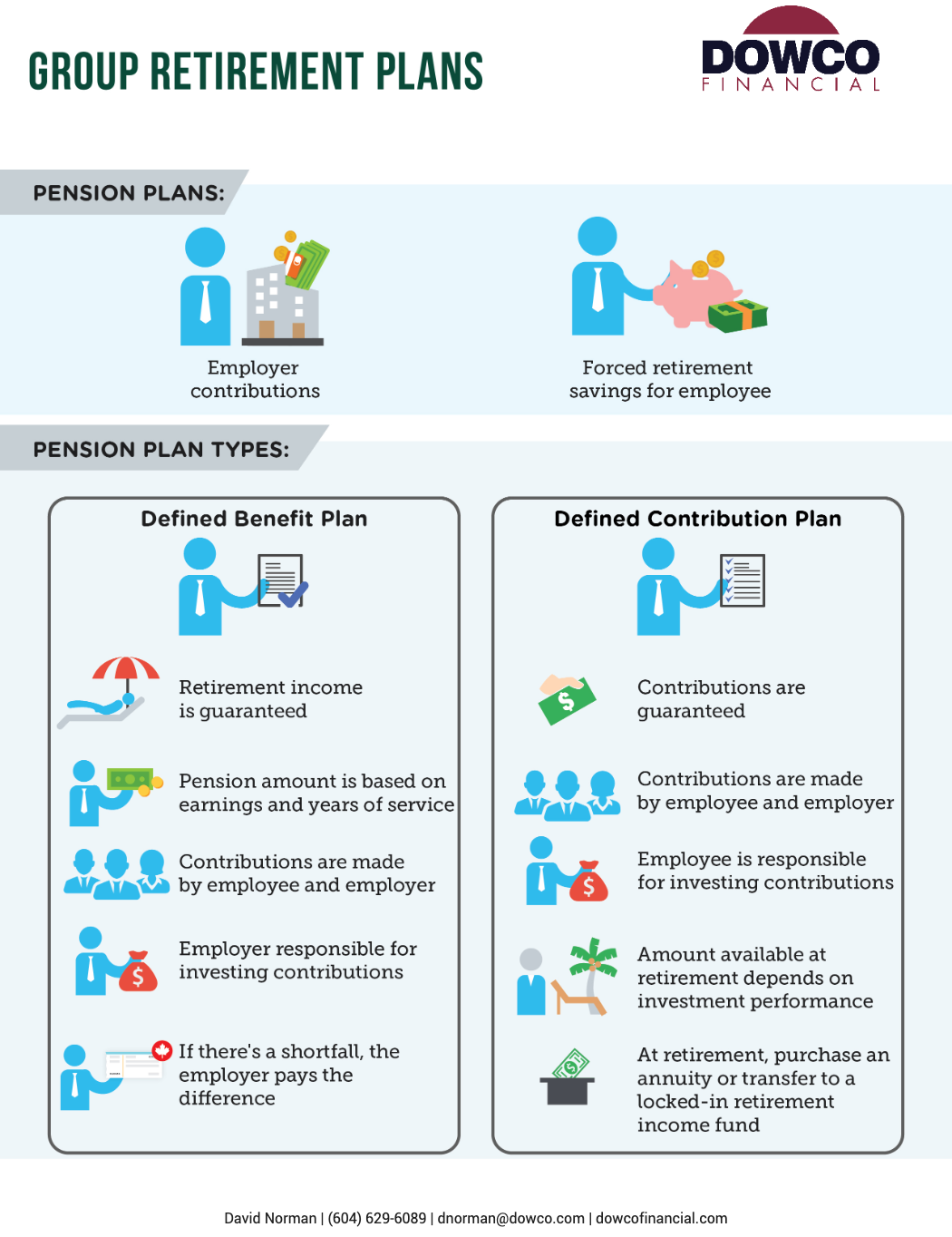

Group insurance plans typically cover medical-related expenses that provincial healthcare plans might not fully address. This coverage can include paramedical and ambulance services, dental care, eye care, hospital stays, and certain prescription drugs. Additionally, you have the option to combine group benefits plans with retirement and savings plans.

Types of Group Benefits Plans

Various types of group benefits plans are available, each catering to different company needs and preferences. The most popular options include:

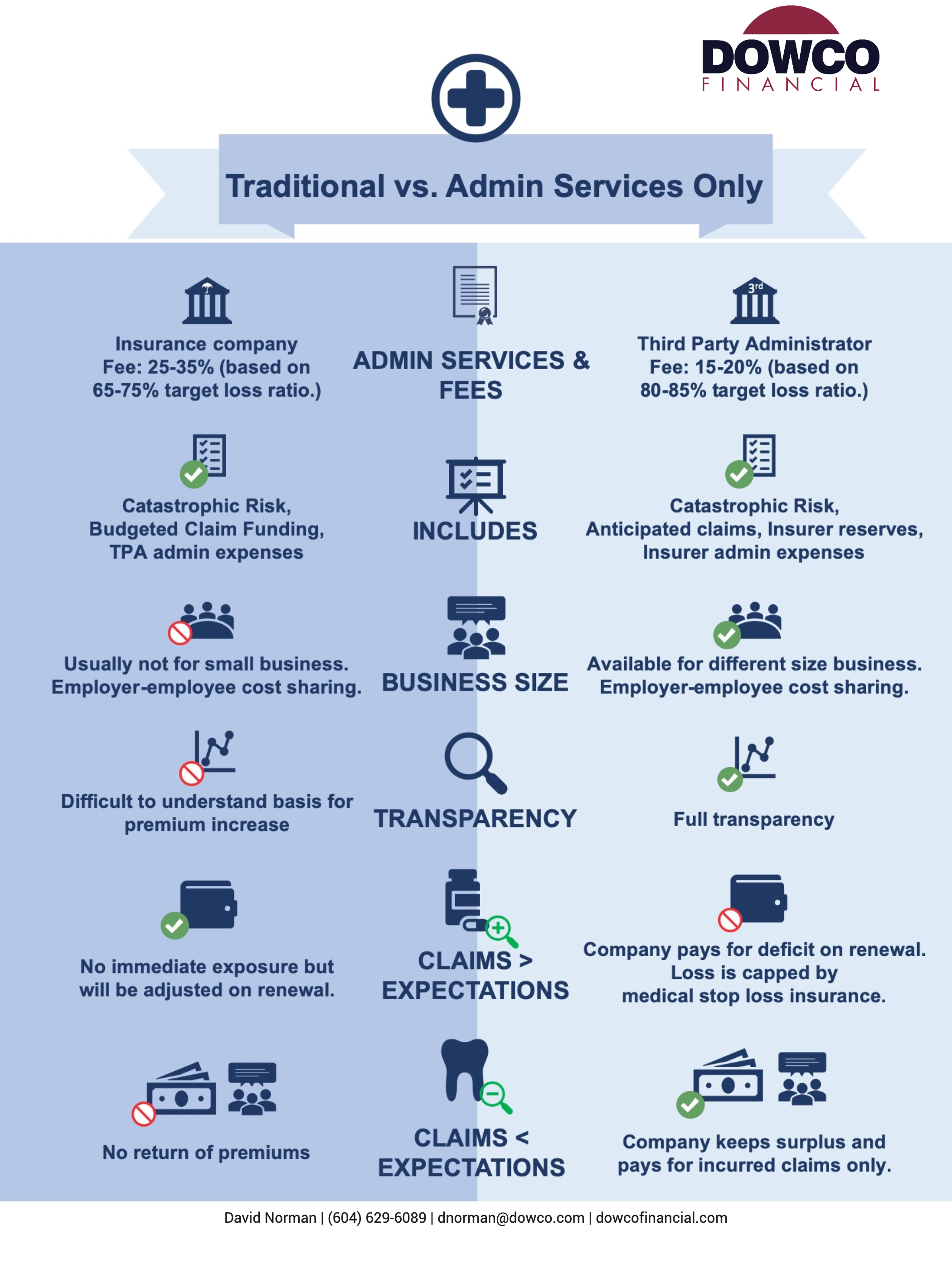

1. Fully-Insured

2. Self-Funded

3. Level-Funded

No matter the size of your business, there’s a group insurance benefit plan that suits your needs. We offer flexible and innovative plans that anticipate your requirements. Our services aim to reduce your administrative workload, allowing you to focus on critical aspects of your business.

Is Group Insurance Cost-Effective?

One of the financial advantages of group insurance is lower premiums while maintaining coverage equivalent to individual health insurance. Typically, employers cover most of the group benefit plan costs, with employees contributing a small percentage of their salary towards the monthly premium. If you’re concerned about the tax implications of providing benefits at work, it’s advisable to with us for specific details.

In conclusion, offering group benefit plans is a strategic move to attract and retain top talent while promoting employee well-being and financial security. Whether you have a small or large business, we are here to assist you in finding the right plan that aligns with your organization’s needs and objectives.