Protecting Key Talent using Group Benefits

Building a Sustainable Future Together

As specialists in group benefits, the primary goal is to cultivate a sustainable future by collaborating closely with clients. The belief is that an informed and engaged workforce is pivotal for the success of any organization. A key component of this vision is the protection of the organization’s essential talent. This article delves into how group benefits can be instrumental in safeguarding an organization’s most treasured resource: its people.

The Importance of Essential Talent

Essential talent encompasses those employees who bring critical skills, expertise, and knowledge that propel an organization’s growth and success. These individuals form the core of any organization, ensuring its prosperity in the competitive market. Retaining such invaluable members is crucial as their absence can significantly affect business operations, productivity, and overall morale.

Challenges in Retaining Essential Talent

In the ever-evolving job market, holding onto essential talent can be a daunting task. Numerous factors, including enticing offers from rivals, opportunities for personal growth, work-life equilibrium, and employee well-being, can influence retention. For employers, recognizing and addressing these challenges is vital to safeguard top performers and sustain a competitive advantage.

The Significance of Group Benefits

Group benefits serve as a potent strategy in attracting and retaining essential talent. By presenting comprehensive and tailored benefits packages, organizations showcase their dedication to the well-being, security, and future of their employees. Here are some pivotal aspects of group benefits that aid in retaining essential talent:

- Health and Wellness Coverage: Offering comprehensive health and wellness benefits, such as medical, dental, and vision plans, not only fosters a healthy workforce but also signifies an organization’s commitment to overall employee well-being. Employees who feel this support are more inclined to stay loyal.

- Income Protection: Many group benefits packages encompass disability insurance, offering financial security for employees facing injuries or illnesses that hinder their work. Such provisions alleviate financial concerns during tough times, fostering a sense of stability and encouraging talent to remain with the organization.

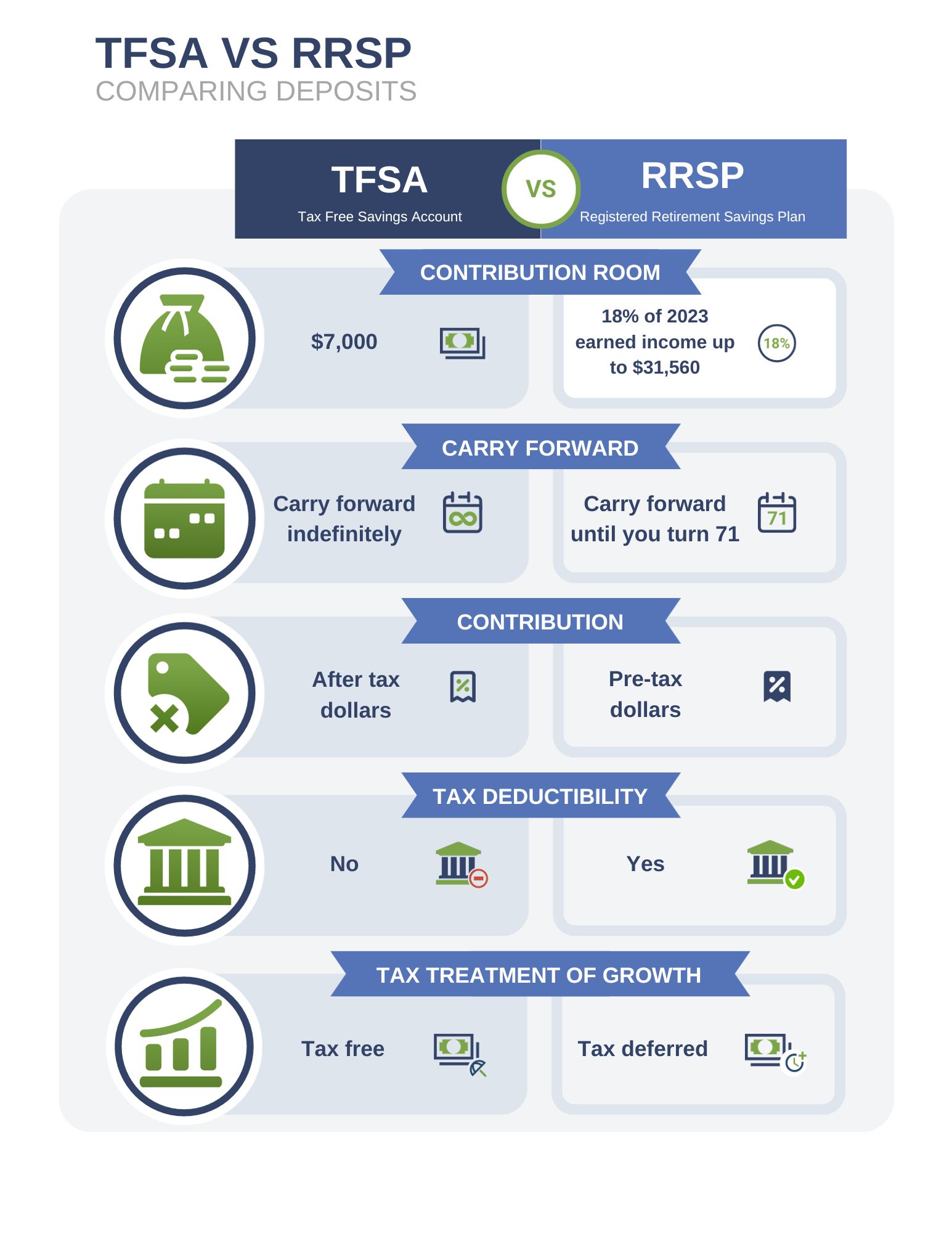

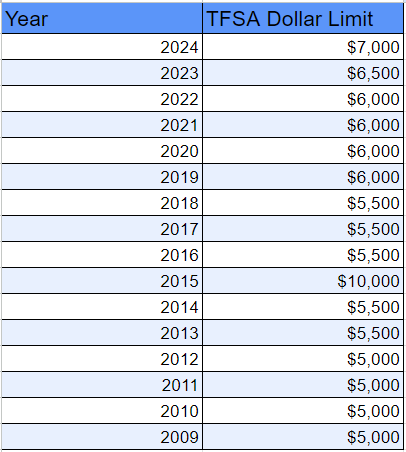

- Retirement Planning: A meticulously crafted retirement plan appeals to essential talent. It signifies an organization’s concern for their future and dedication to ensuring their financial comfort during retirement. Contributing to such plans also strengthens the bond between employers and employees.

- Support for Work-Life Balance: Benefits that champion work-life balance, like flexible work schedules, paid leaves, and family leaves, reflect an organization’s understanding of the significance of a balanced life. Employees who sense this flexibility are more likely to remain devoted.

- Career Advancement: Benefits can also encompass professional development and training opportunities. Investing in employee growth not only sharpens their skills but also underlines an organization’s commitment to their long-term achievements.

Educational Approach and Teamwork

The role of group benefits specialists is to offer educational support and foster collaboration with clients. Through open dialogues about an organization’s aspirations and needs, it’s possible to design group benefits packages that resonate with specific demands. The collective goal is to nurture and protect essential talent, ensuring a sustainable future.

Protecting essential talent through group benefits is more than a strategic move; it embodies a dedication to employee welfare. By investing in the well-being, security, and future of employees, organizations not only boost loyalty and retention but also lay the foundation for a robust and sustainable future. The journey ahead is one of partnership, aiming for a flourishing and vibrant workforce.