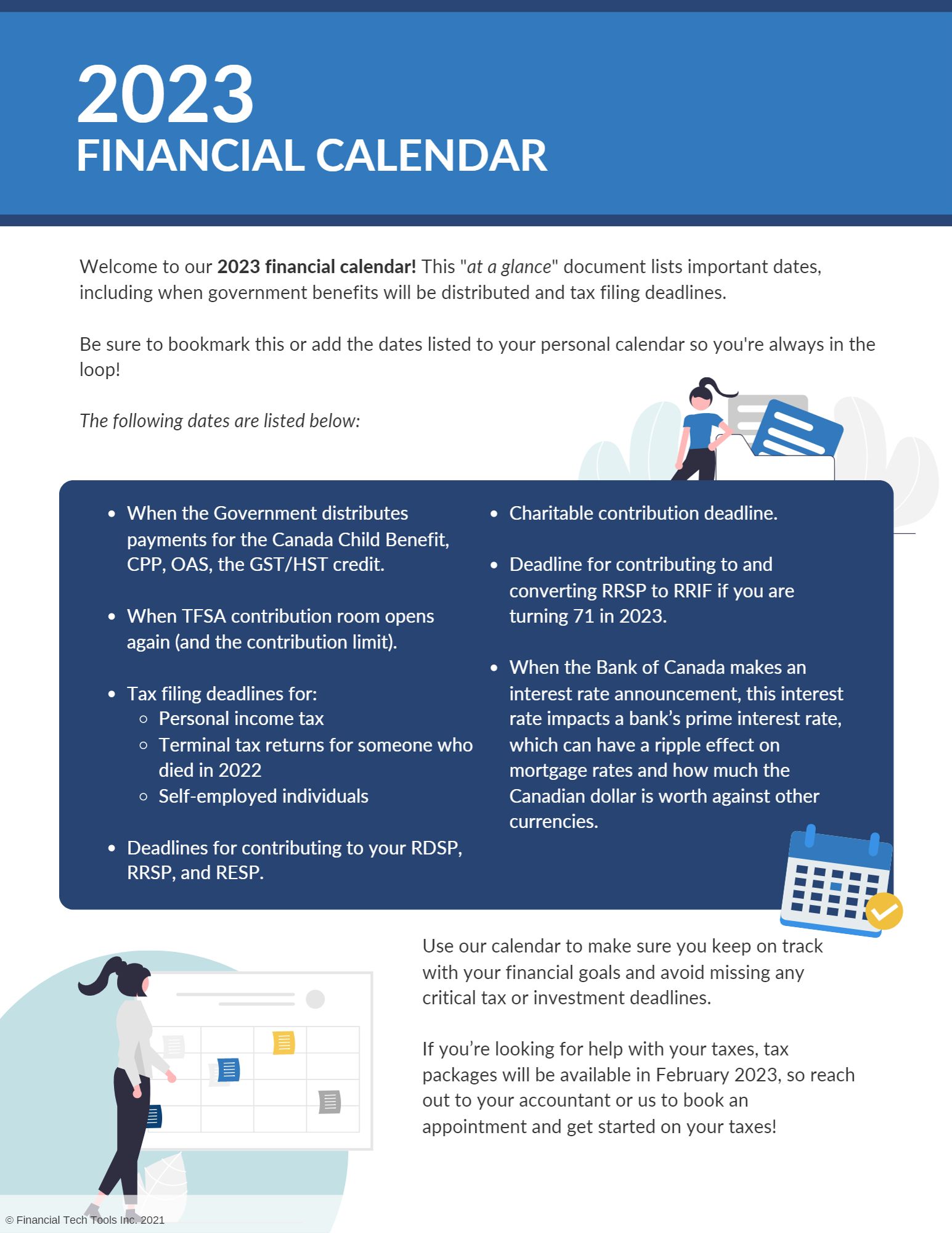

2023 Financial Calendar

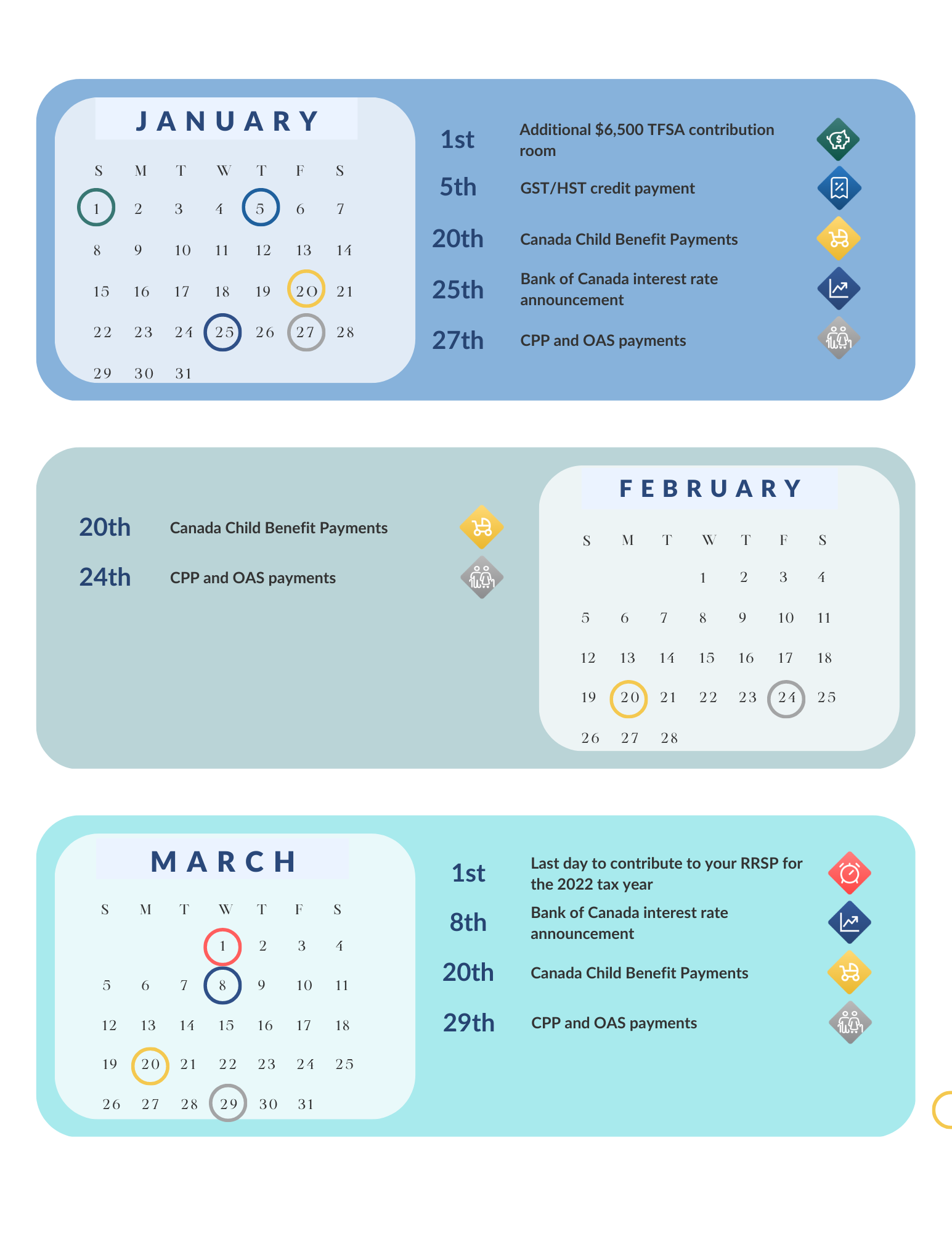

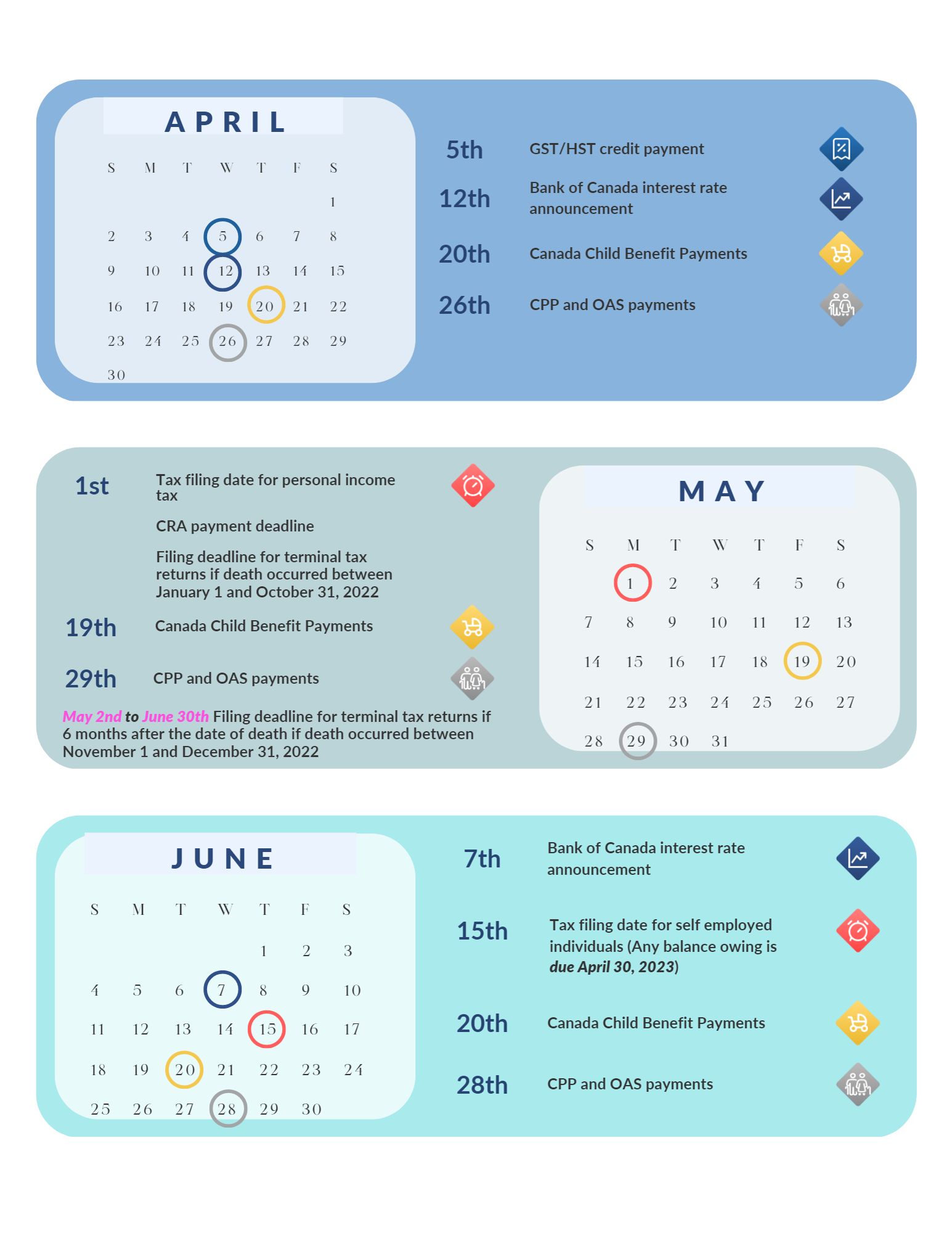

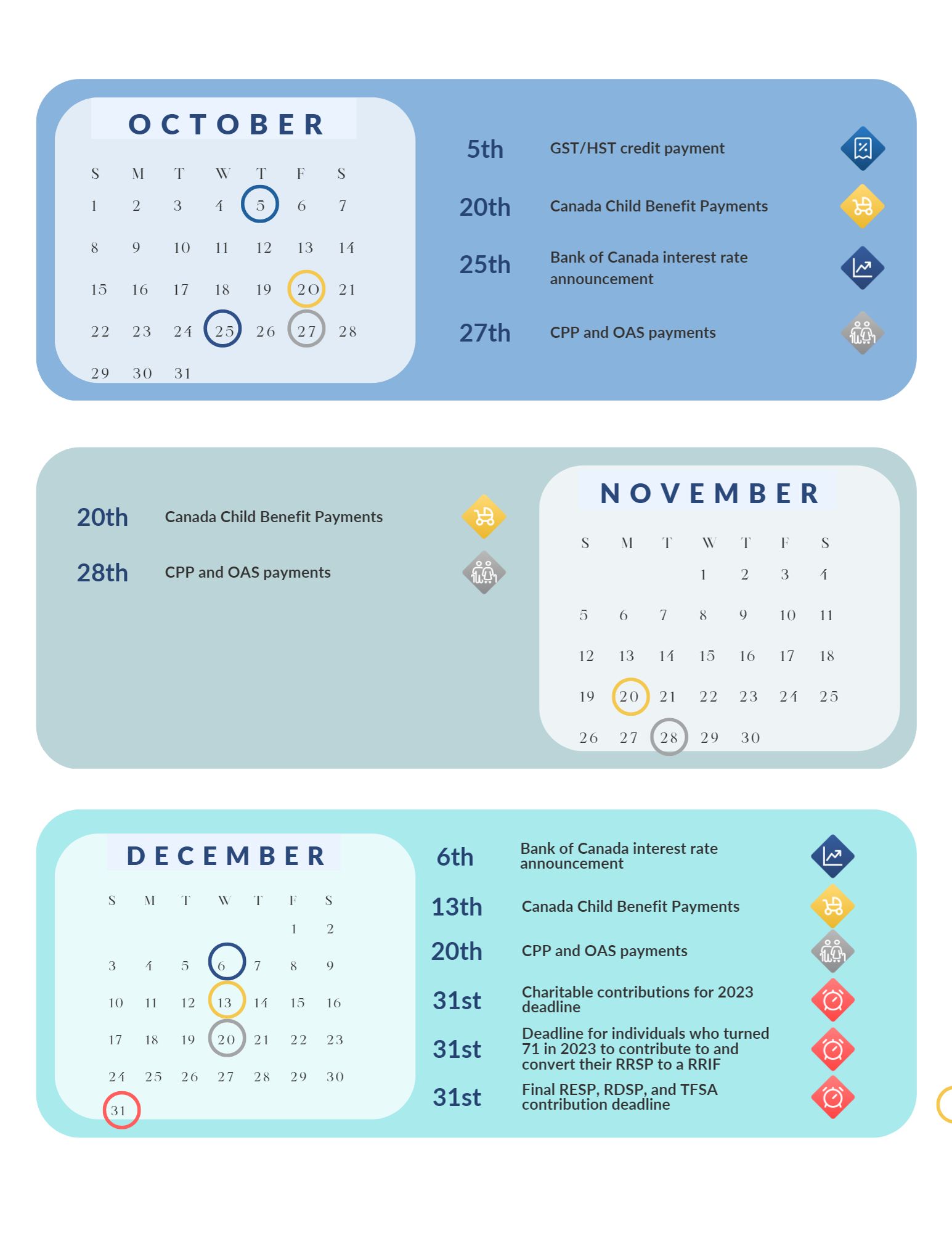

Welcome to our 2023 financial calendar! This calendar is designed to help you keep track of important financial dates and deadlines, such as tax filing and government benefit distribution. You can bookmark this page for easy reference or add these dates to your personal calendar to ensure you don’t miss any important financial obligations.

If you need help with your taxes, tax packages will be available starting February 2023. Don’t wait until the last minute to get started on your tax return – make an appointment with your accountant to ensure you’re ready to go when tax season arrives.