British Columbia’s 2024 Budget Highlights

On February 22, 2024, the B.C. Minister of Finance announced the province’s 2024 budget. This article highlights the most important things you need to know about this budget, broken into 3 sections:

-

Real Estate

-

Personal Tax Changes

-

Business Tax Changes

Real Estate

Home Flipping Tax Introduced

Effective January 1, 2025, the home flipping tax applies to properties sold within a short holding period of 365 days. Sellers who dispose of residential properties within this timeframe will incur a 20% tax on the income generated from the sale. The tax rate gradually decreases to 0% for properties held between 366 and 730 days. It’s important to note that this tax applies globally, affecting both British Columbia residents and non-residents selling properties within the province.

The tax encompasses various types of residential properties, including those with housing units and properties zoned for residential use. Additionally, income generated from contract assignments is also subject to this tax. However, the tax does not apply to land or portions of land used for non-residential purposes.

Property Transfer Tax Exemption Thresholds Increased:

Effective April 1, 2024, first-time home buyers can benefit from an increased threshold of $835,000, with properties valued under $500,000 being fully exempt from the tax. Furthermore, purchasers of qualifying newly built homes see an increase in the exemption threshold to $1.1 million for principal residences. This measure aims to alleviate the financial burden on first-time buyers and encourage investment in new housing developments.

Speculation and Vacancy Tax – Registered Occupier:

Starting January 1, 2024, individuals holding residential properties under a registered lease will be considered the registered occupiers of these properties for taxation purposes. This means that leaseholders will be required to declare the use of the property annually, with declarations for activities occurring in 2024 commencing in 2025. This measure aims to ensure that registered leaseholders accurately report their property usage.

Personal tax changes

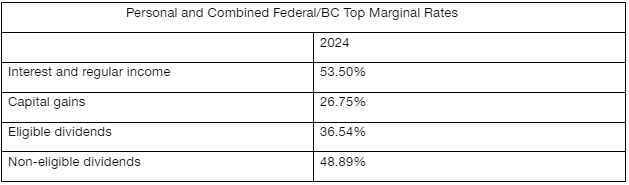

There are no changes to the province’s personal tax rates in Budget 2024.

As a result, the B.C.’s personal income tax rate remains as follows:

BC Family Benefit Bonus:

Effective July 1, 2024, the annual benefit amounts and income thresholds used to determine eligibility for the B.C. Family Benefit are increased by 25%. However, these adjustments are temporary and will revert to previous levels at the end of the 12-month benefit period. This enhancement aims to provide additional financial assistance to families facing economic challenges during the specified period.

Provincial Sales Tax Changes:

Several amendments to the Provincial Sales Tax (PST) rules are introduced to streamline tax administration and ensure fairness in taxation:

-

Reduction in PST refunds for goods intended for export but resold within British Columbia aims to prevent abuse of export-related tax benefits.

-

Broadening of the “software” definition for PST purposes, retroactive to April 1, 2013, addresses ambiguities and aligns with the evolving landscape of digital products and services.

-

Clarification on PST refunds for self-assessed goods returned to non-PST collecting sellers aims to simplify tax refund processes and reduce administrative burdens.

-

Inclusion of clean energy production machinery in PST exemptions aims to incentivize investment in renewable energy infrastructure and support climate action initiatives.

-

Clarification on taxable services provided with leased goods ensures consistency and clarity in tax treatment, reducing potential disputes and improving compliance.

-

Expansion of administrative penalties’ application aims to deter non-compliance and ensure adherence to tax laws, thereby safeguarding revenue integrity.

Climate Action Tax Credit Payment Increase:

Effective July 1, 2024, adult recipients will see an increase to $504, spouses or common-law partners to $252, and children to $126. Furthermore, income thresholds for credit phase-outs are adjusted upwards, allowing more individuals and families to benefit from the tax credit. These adjustments aim to alleviate financial burdens associated with climate action initiatives and promote environmental sustainability